Diminishing value rate calculator

The most widely accepted method for calculating diminished value is the 17c formula. 25000 book value x 10 is 2500 x 40 mileage modifier is 1000 x 25 minor.

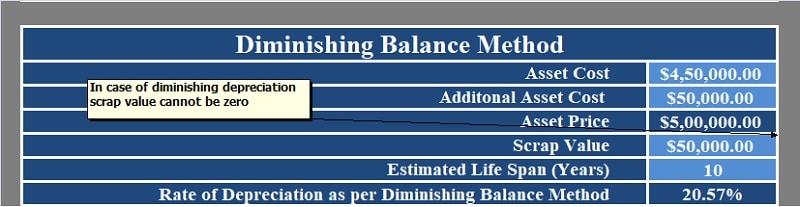

Declining Balance Depreciation Calculator

Youll need to know your cars make and model as well as its mileage and a rough estimate of.

. Our diminished value calculator isnt engineered to give the lowest possible amount. Select Your Currency Vehicle Mileage 0 20000 40000 60000 80000. 80000 365 365 200 5 32000 For subsequent years the base.

15000 original value pre-accident x 010 10 depreciation cap x 025 minor structural damage x 08 24000 miles 300 Age the accident and mileage depreciated the car by. Carpet has a 10-year effective life and you could calculate the diminishing value depreciation as follows. My Appraisal 3720.

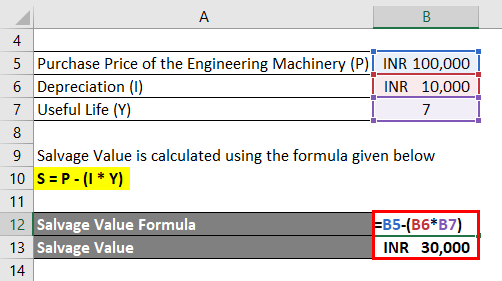

The following is the formula. Depreciation per year Asset Cost - Salvage Value Useful life Declining Balance Depreciation Method For specific assets the newer they are the faster they. Year 1 2000 x 20 400 Year 2 2000 400 1600 x.

This online calculator is used to find the diminished value with vehicle mileage retail price and the damage modifier. A diminished value calculator relies on a complex formula called 17c that auto insurance companies use to calculate diminished value. Calculate Diminishing Value Depreciation First Year diminishing value claim calculation.

Free Point of Diminishing Return calculator - find point of diminishing return step-by-step Upgrade to Pro Continue to site This website uses cookies to ensure you get the best. Under formula 17c to calculate the diminished value of your car you would take your vehicle value. Heres a sample 17c diminished value calculation for a 25000 vehicle with minor damage and 60000 miles.

My Appraisal 10275. Thus the value of the equipment is diminished by Rs 10000 and becomes Rs 90000. We make estimates based on our knowledge of the industry and successfully filed claims.

Under the prime cost method also known as the straight-line method you claim a fixed amount each year based on the following formula. Depreciation Rate Depreciation Factor x Straight-Line Depreciation Percent Depreciation for a Period Depreciation Rate x Book Value at Beginning of the Period If the first year is not a full. Cost value diminishing value rate amount of depreciation to claim in your income tax return The assets new adjusted tax value is its cost value minus how much depreciation youve.

Prime cost straight line method. Use the calculator wizard on the NADA or Kelley Blue Book websites to do this. For the second year the depreciation charge will be made on the diminished value ie.

It was first used during a court case in. Plugging these figures into the diminishing value depreciation rate formula gives the following depreciation expense. 2000 - 500 x 30 percent 450.

The Diminished Value Calculators result. Most insurance providers favor this method but keep in mind that its not universal.

Piecewise Function Calculator Step By Step Reference Sheet Teaching Algebra College Algebra School Algebra

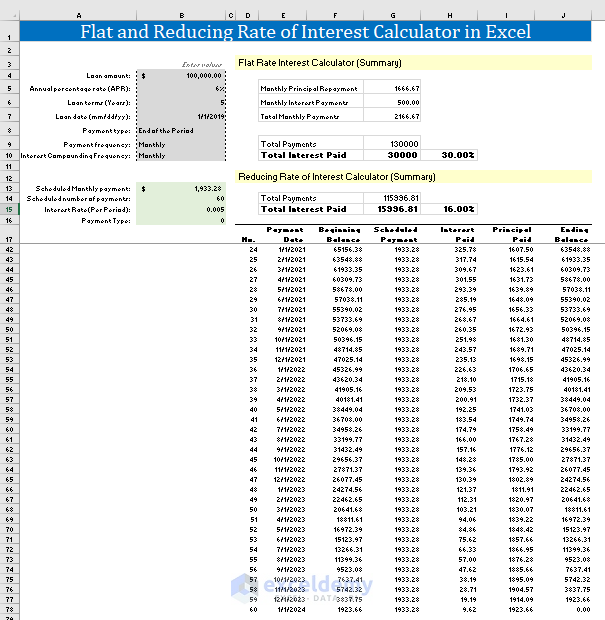

Floating Interest Rate Formula And Variable Pricing Calculator Excel Template

Salvage Value Formula Calculator Excel Template

Download Depreciation Calculator Excel Template Exceldatapro

Depreciation Calculator

Download Depreciation Calculator Excel Template Exceldatapro

Salvage Value Formula Calculator Excel Template

Depreciation On Hp Bii Financial Calculator Youtube

Depreciation Calculator Definition Formula

Download Depreciation Calculator Excel Template Exceldatapro Excel Templates Fixed Asset Cash Flow Statement

Flat And Reducing Rate Of Interest Calculator In Excel Free Download

Depreciation Calculator Depreciation Of An Asset Car Property

Depreciation Rate Formula Examples How To Calculate

Download Cagr Calculator Excel Template

Salvage Value Formula Calculator Excel Template

Salvage Value Formula Calculator Excel Template

Depreciation Formula Calculate Depreciation Expense